Proud to Work with Over 90 Organisations Globally

Our Customers

Founded in 2009, LAB Group provides streamlined digital customer acquisition, identity verification, and onboarding technology to the financial services industry globally.

LAB Group’s digital customer acquisition and onboarding Software-as-a-Service supports a seamless, secure, and compliant customer journey and LAB’s technology continuously evolves to meet the constantly changing Know Your Customer and Compliance demands of regulators.

Get Started

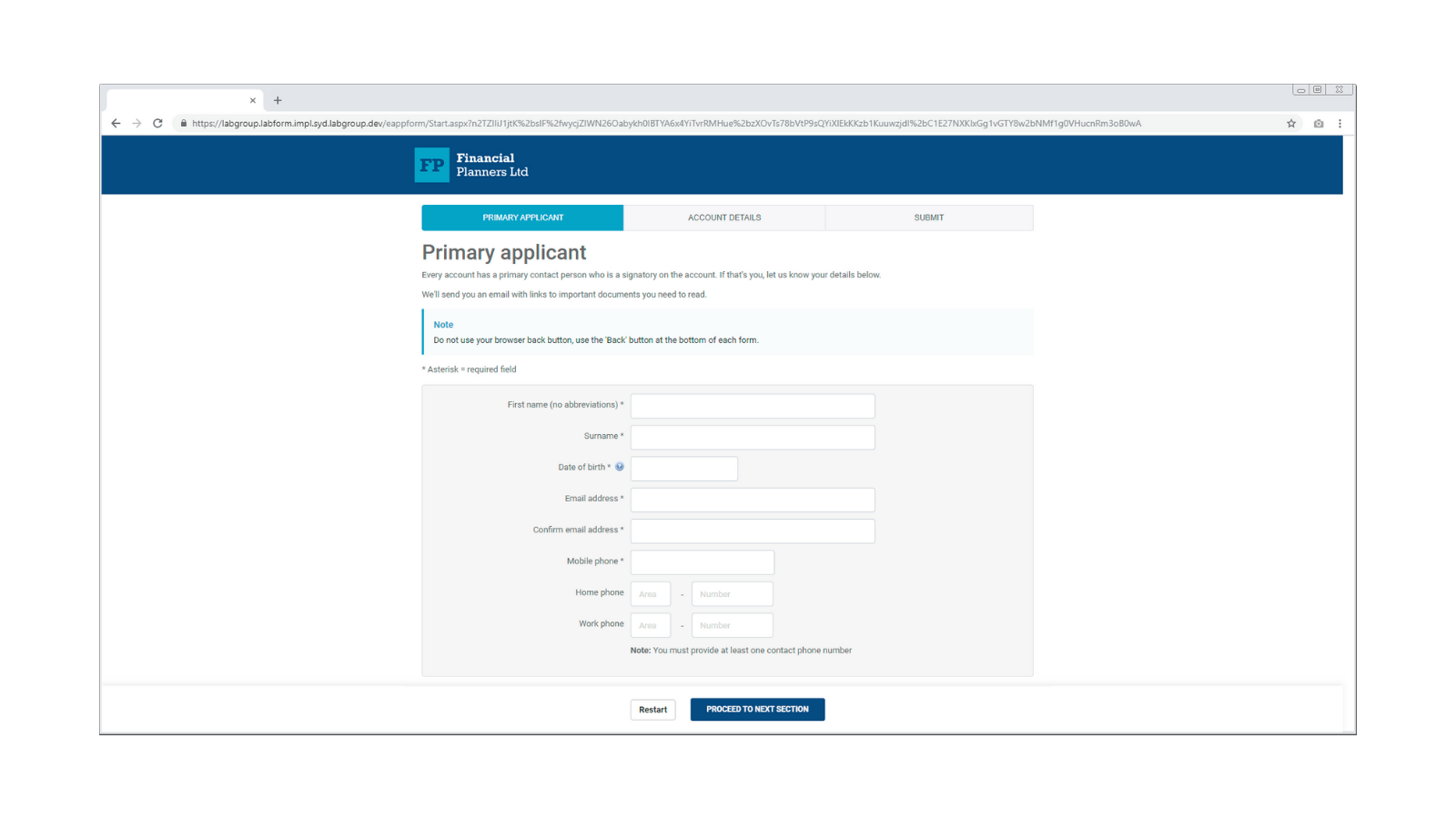

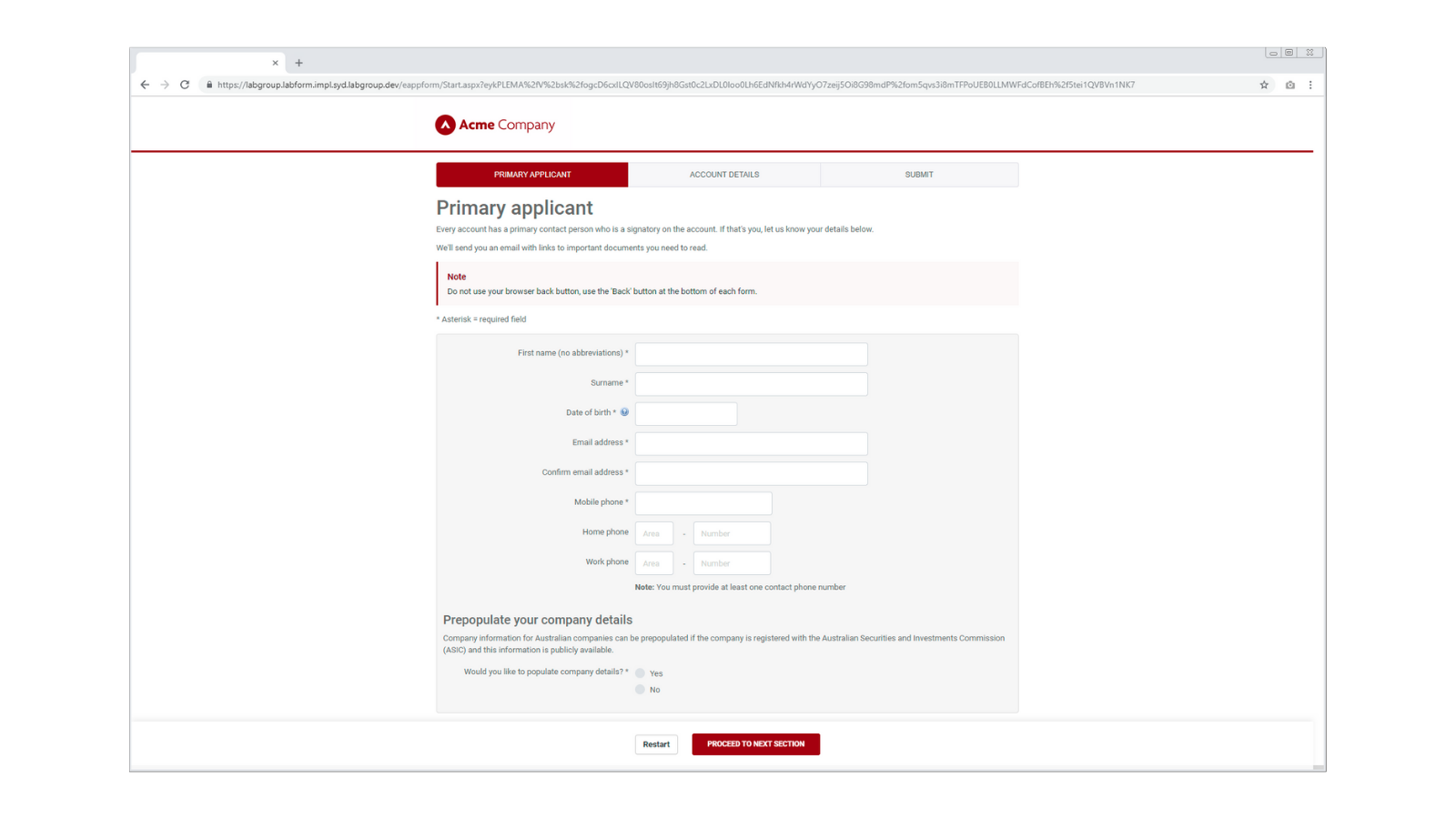

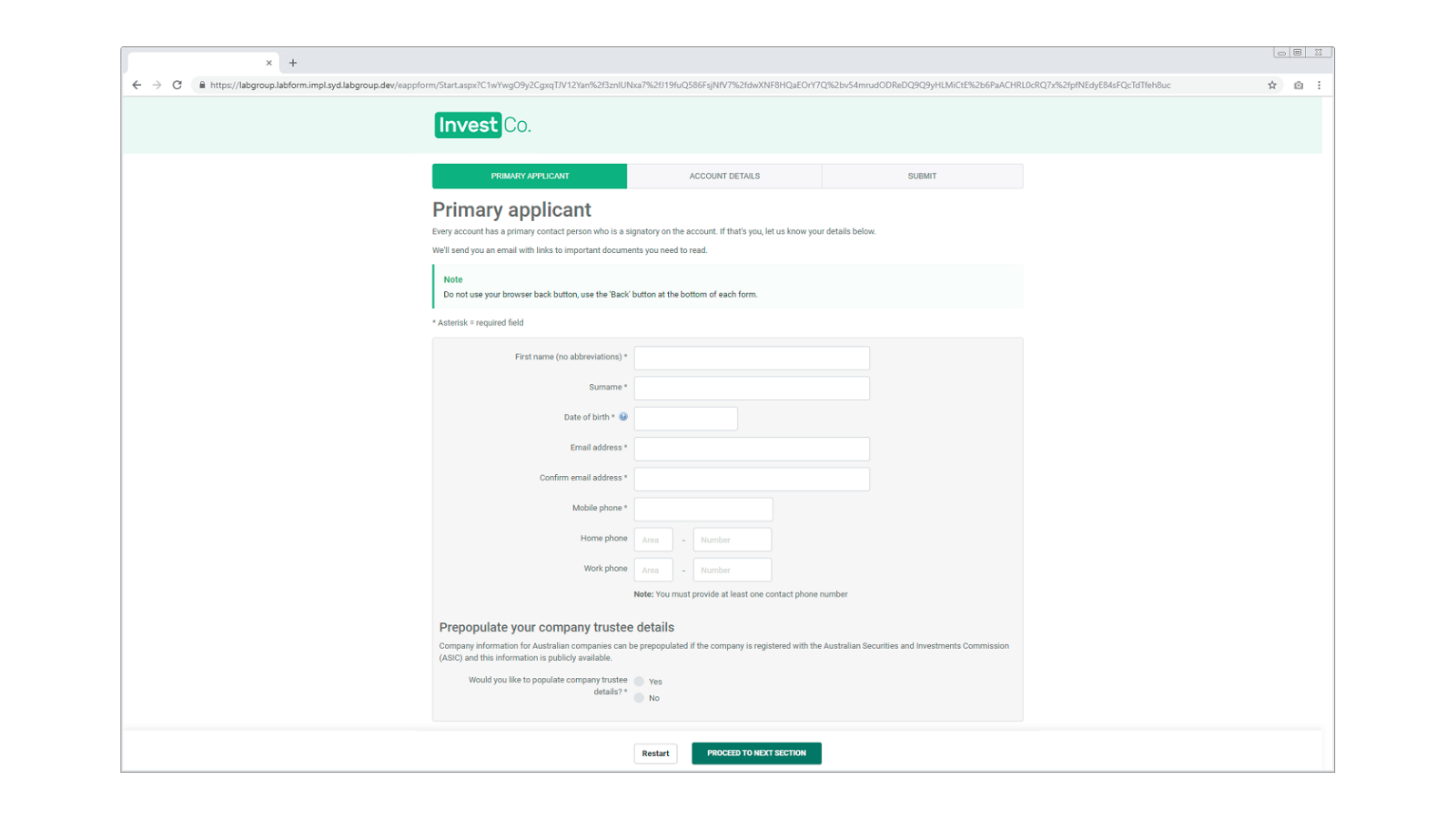

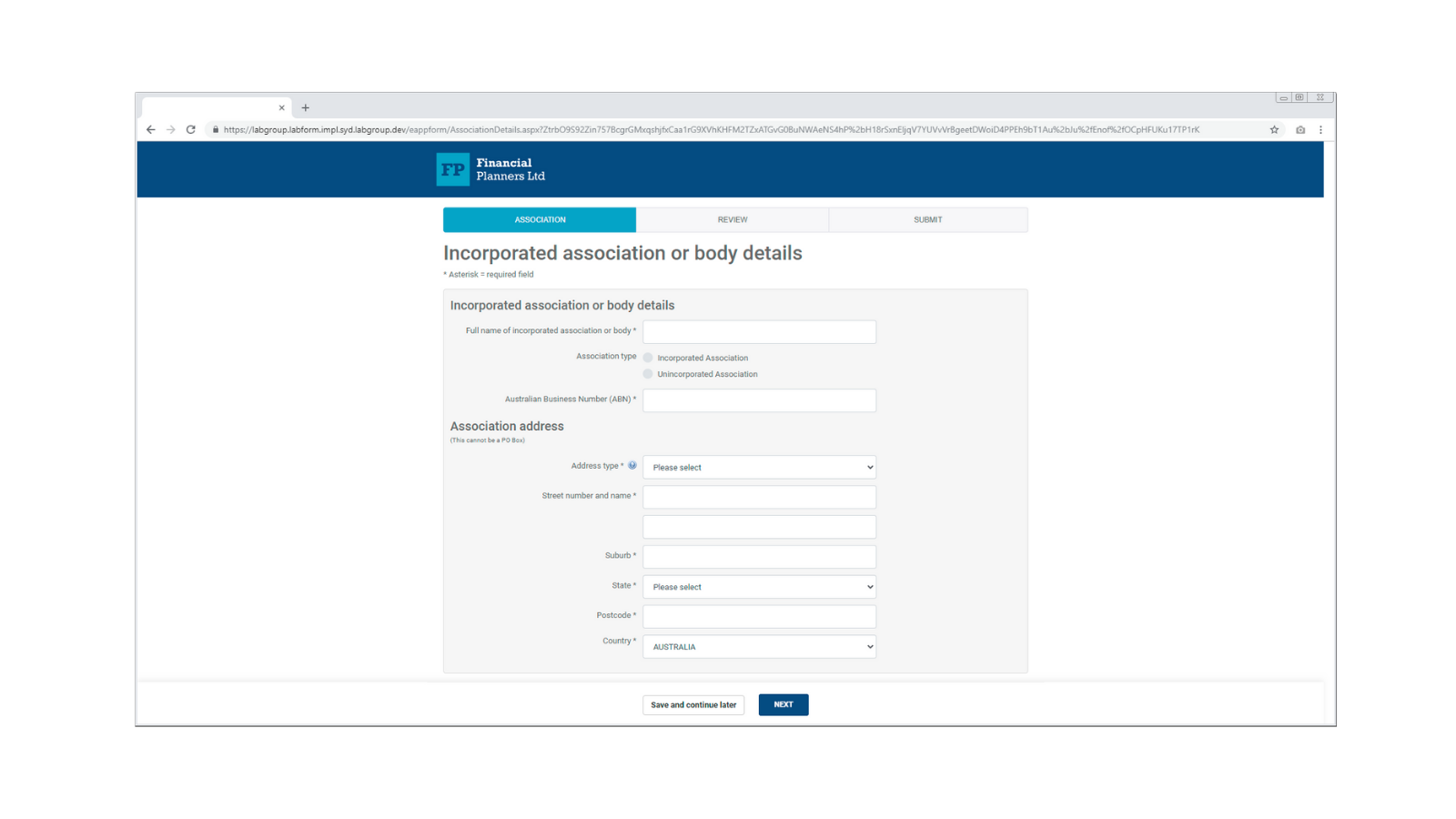

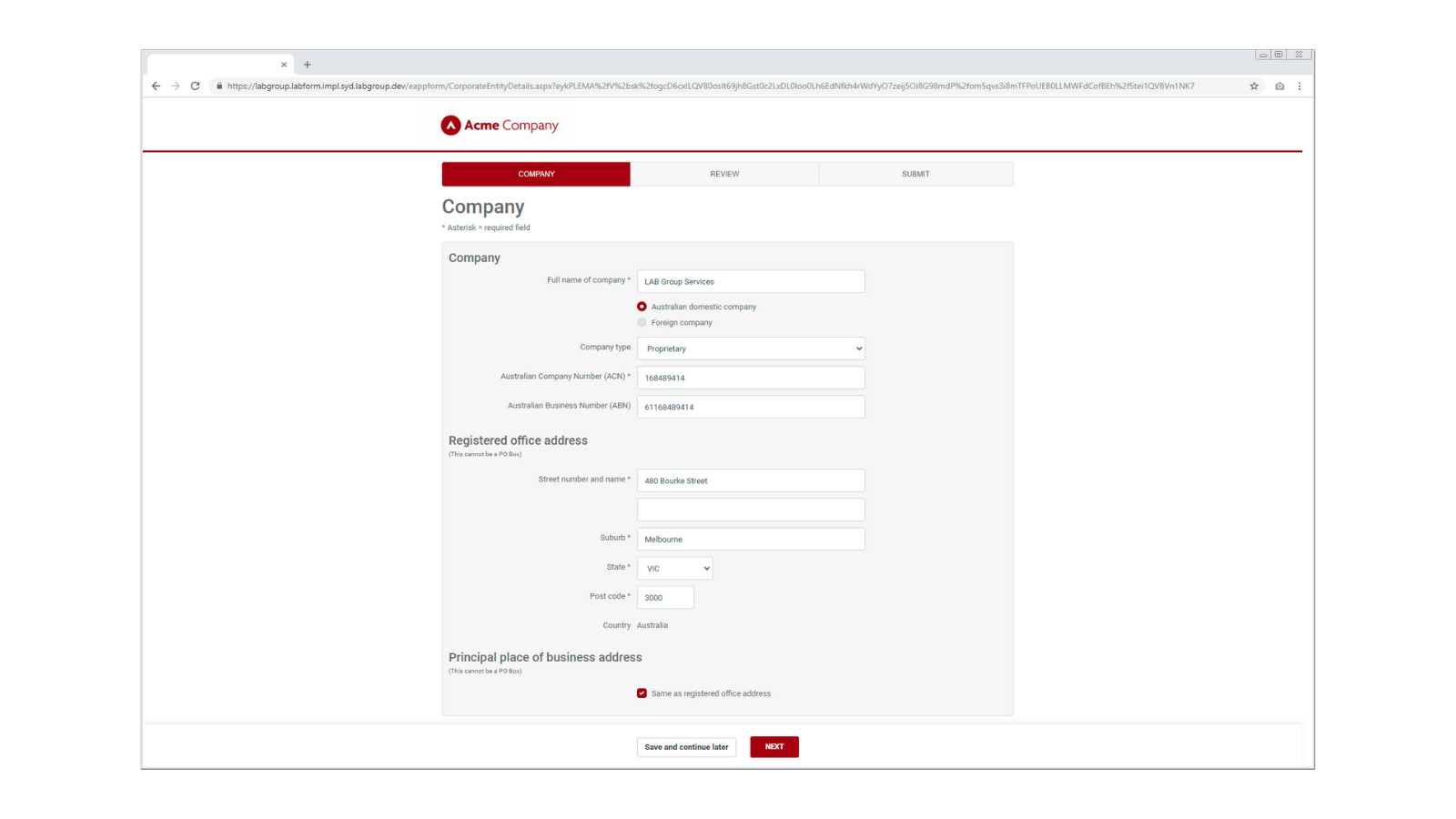

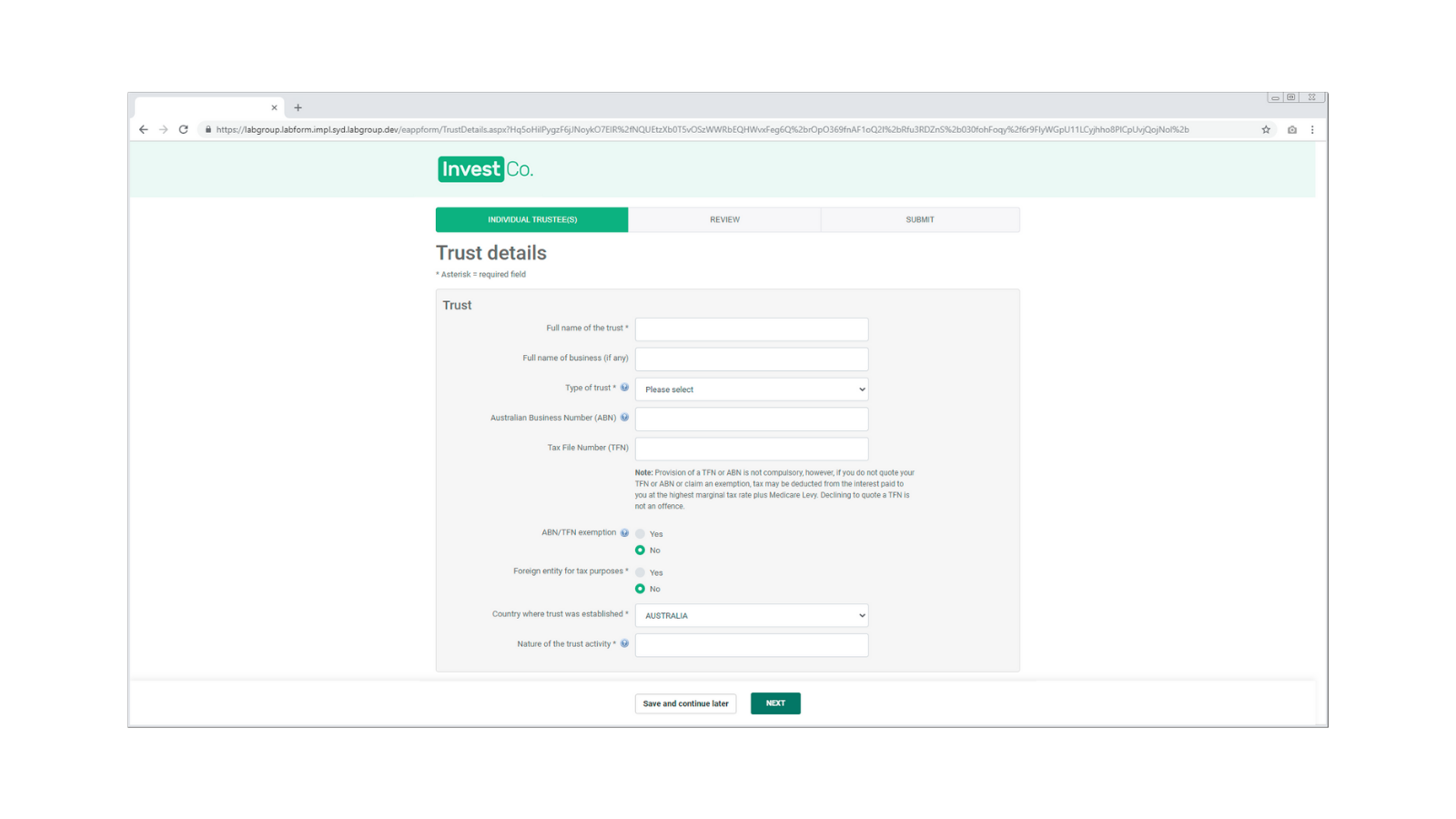

After visiting your website, customer’s apply for your financial products or services via your branded version of LABform.

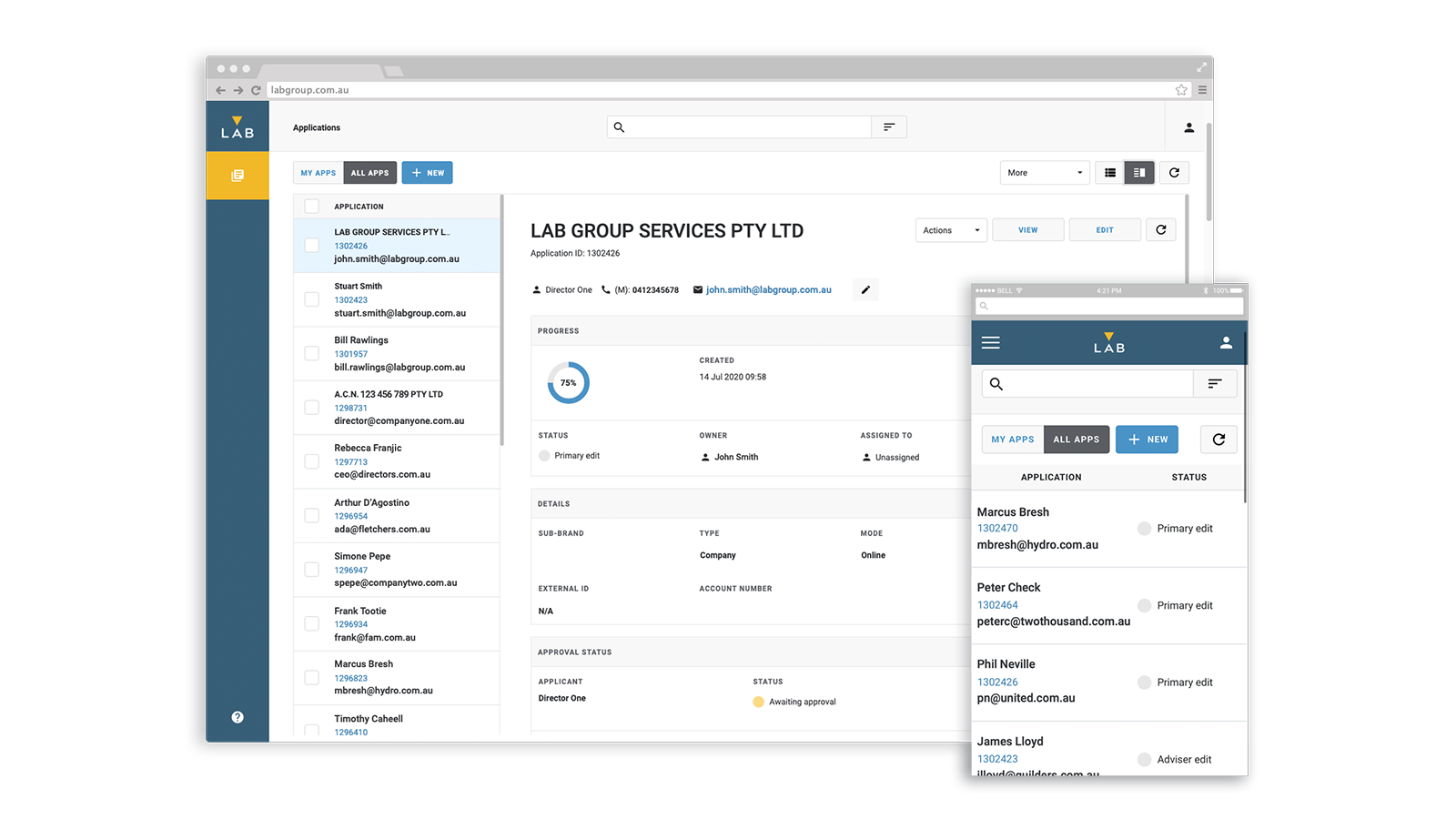

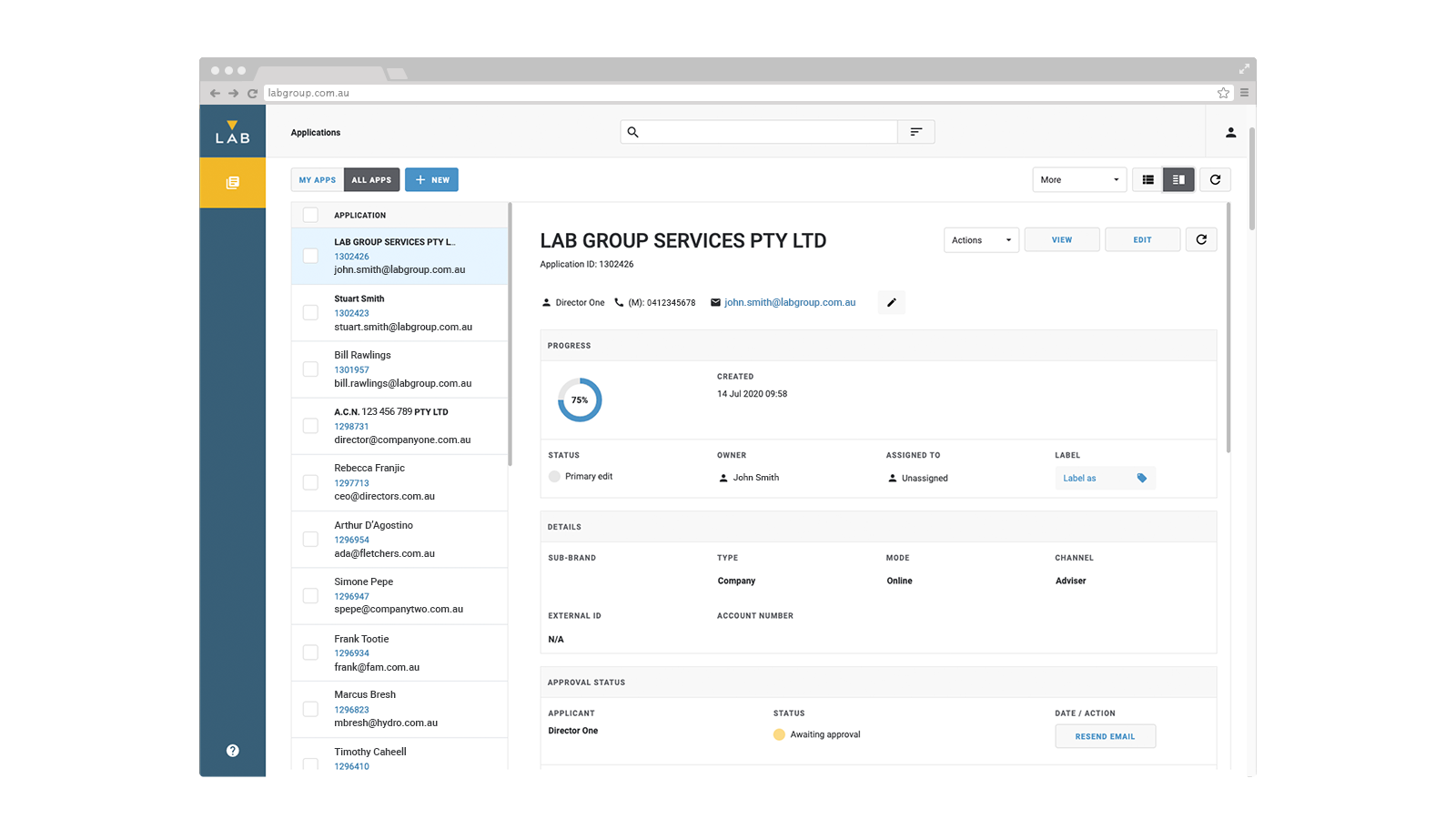

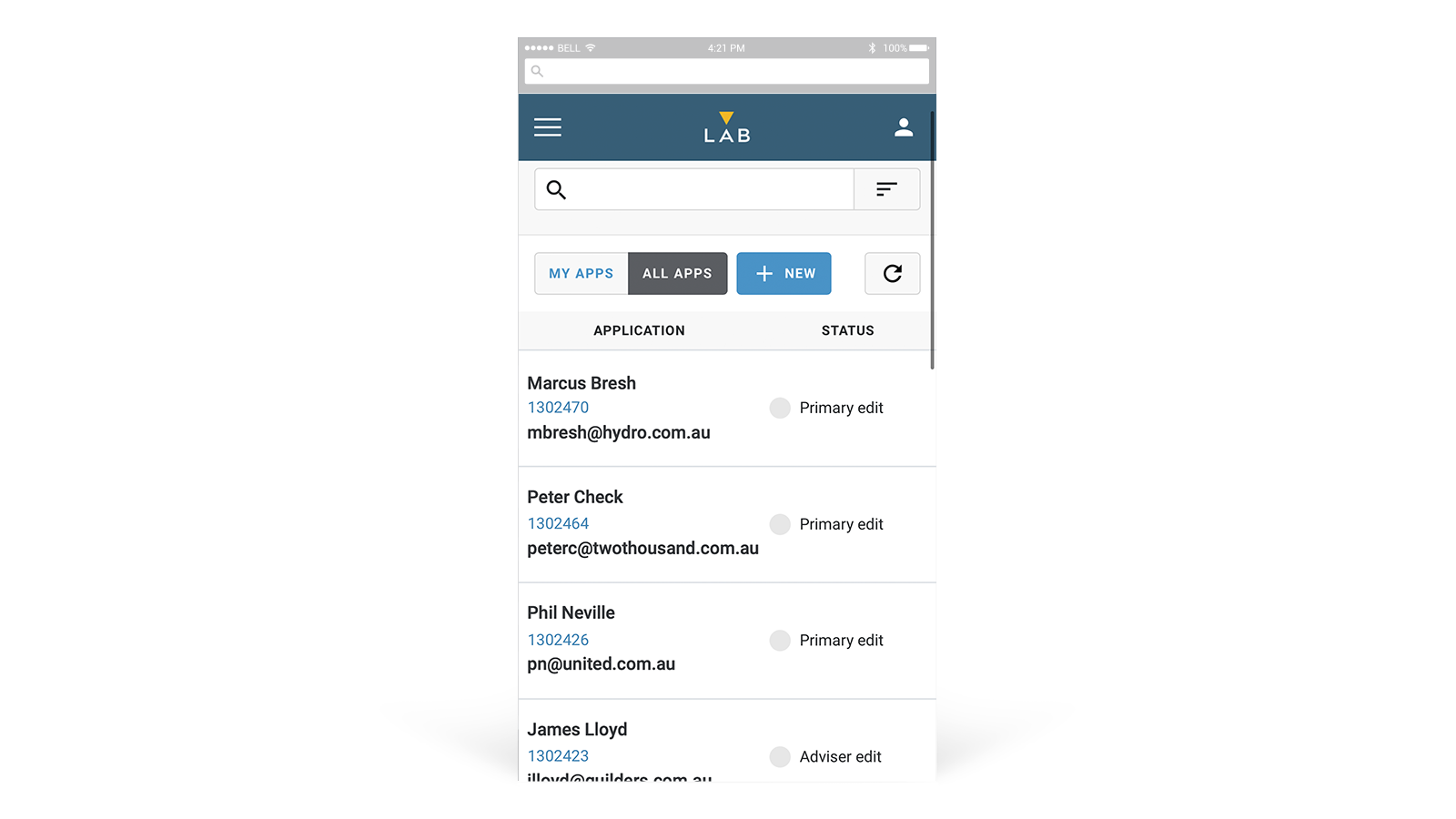

Your Staff utilise LAB’s Application Manager to manage applications on a customers behalf.

Provide a seamless customer experience and optimise your business efficiencies.

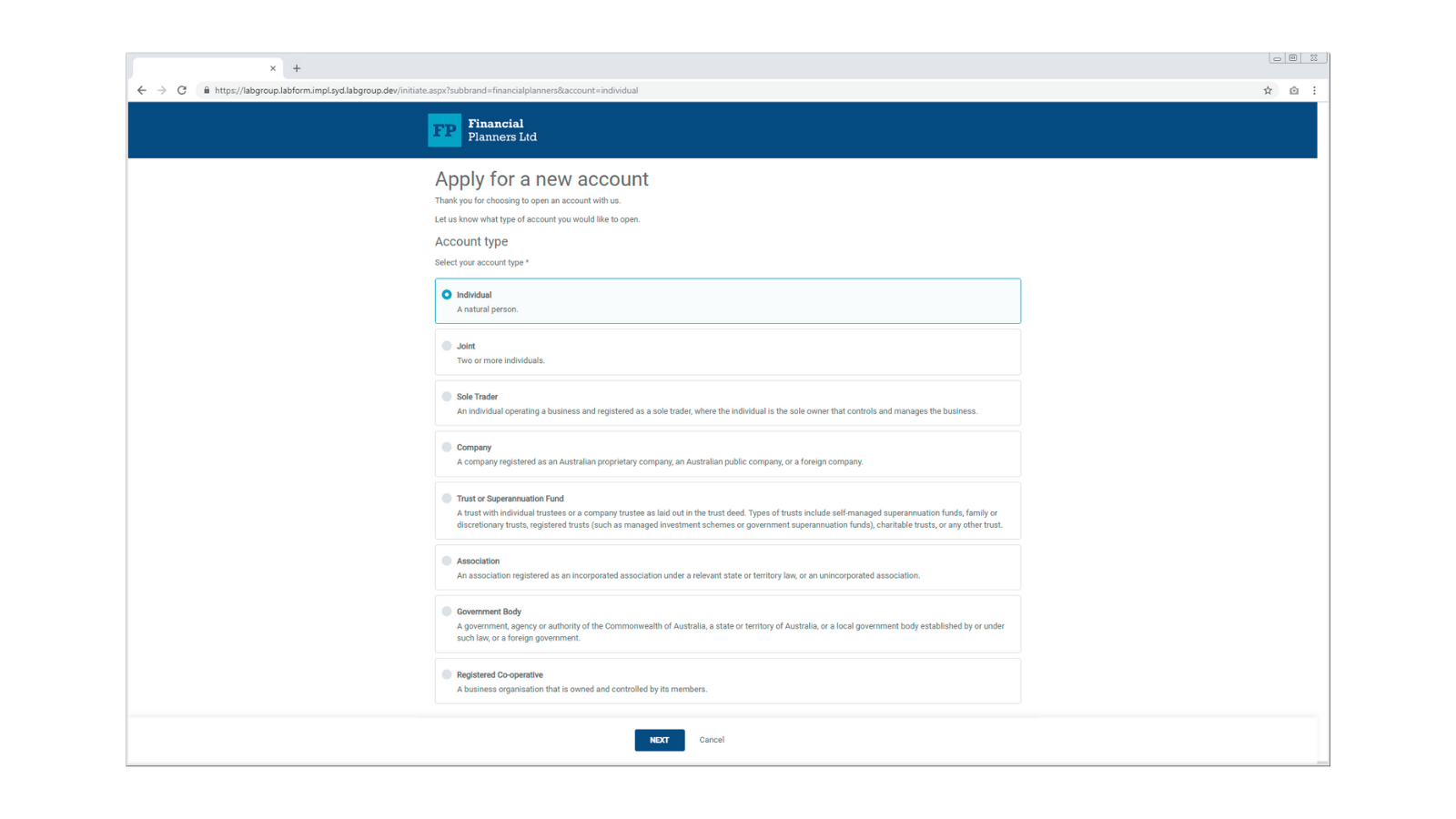

Online Applications with LABform

User friendly. Streamlined approach. Fast approval.

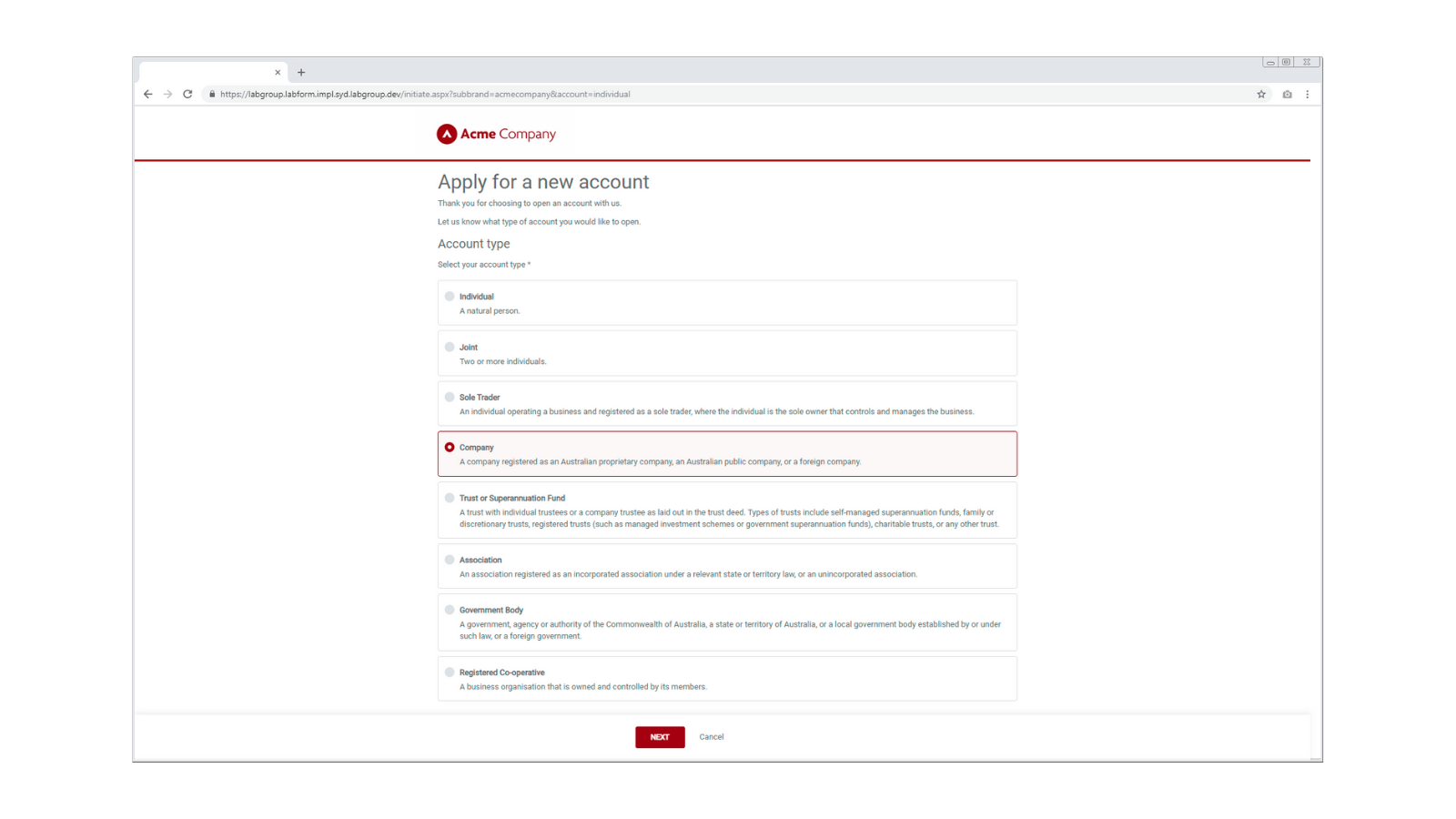

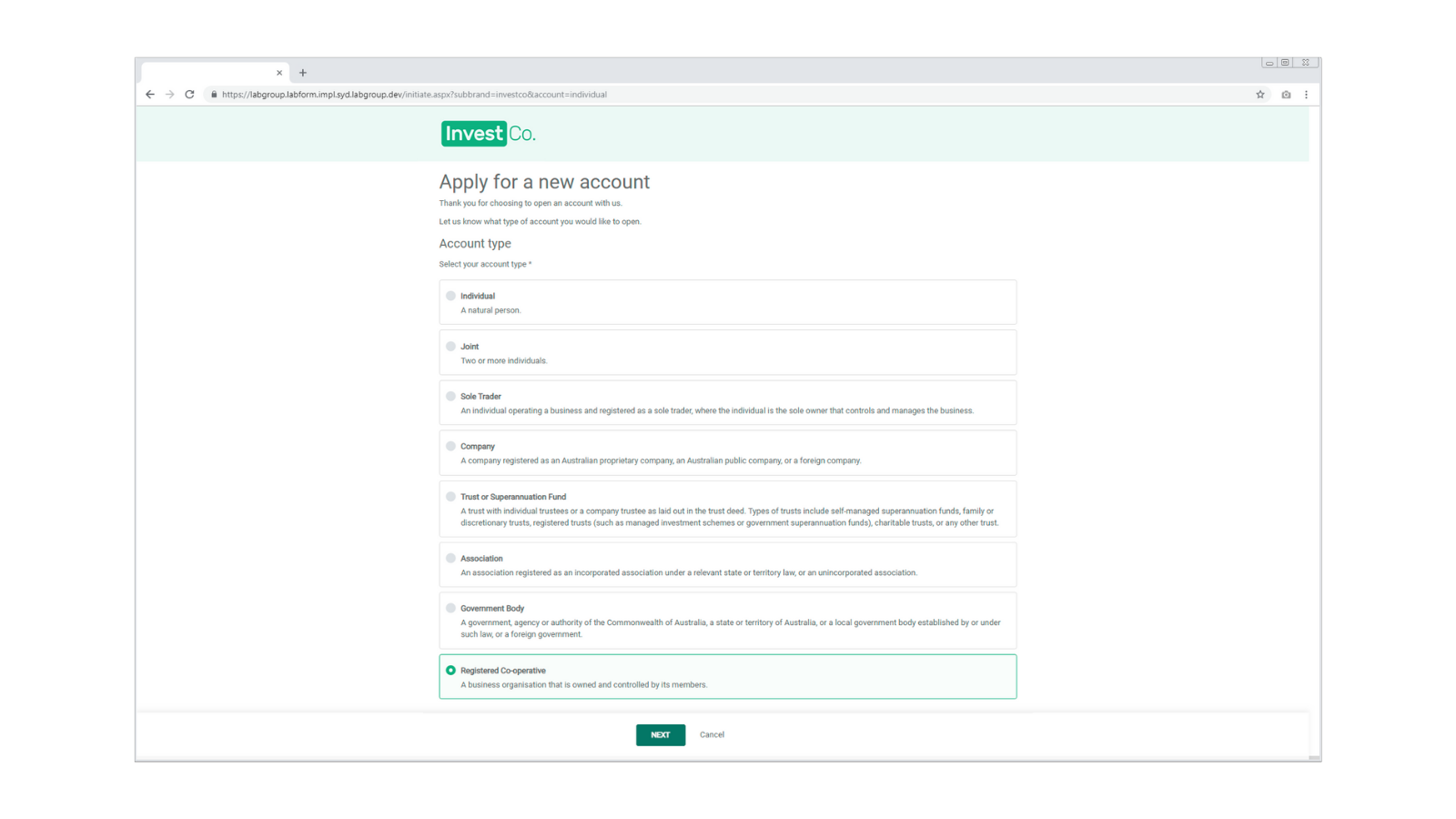

LABform makes even the most complex application processes completely digital and supports all nine entity types recognised under the Anti Money Laundering/Counter-Terrorism Financing legislation. Our user friendly, multi-lingual forms support all application types including complex applications for self-managed super funds and provide an innovative digital signature process to further streamline the acquisition process.

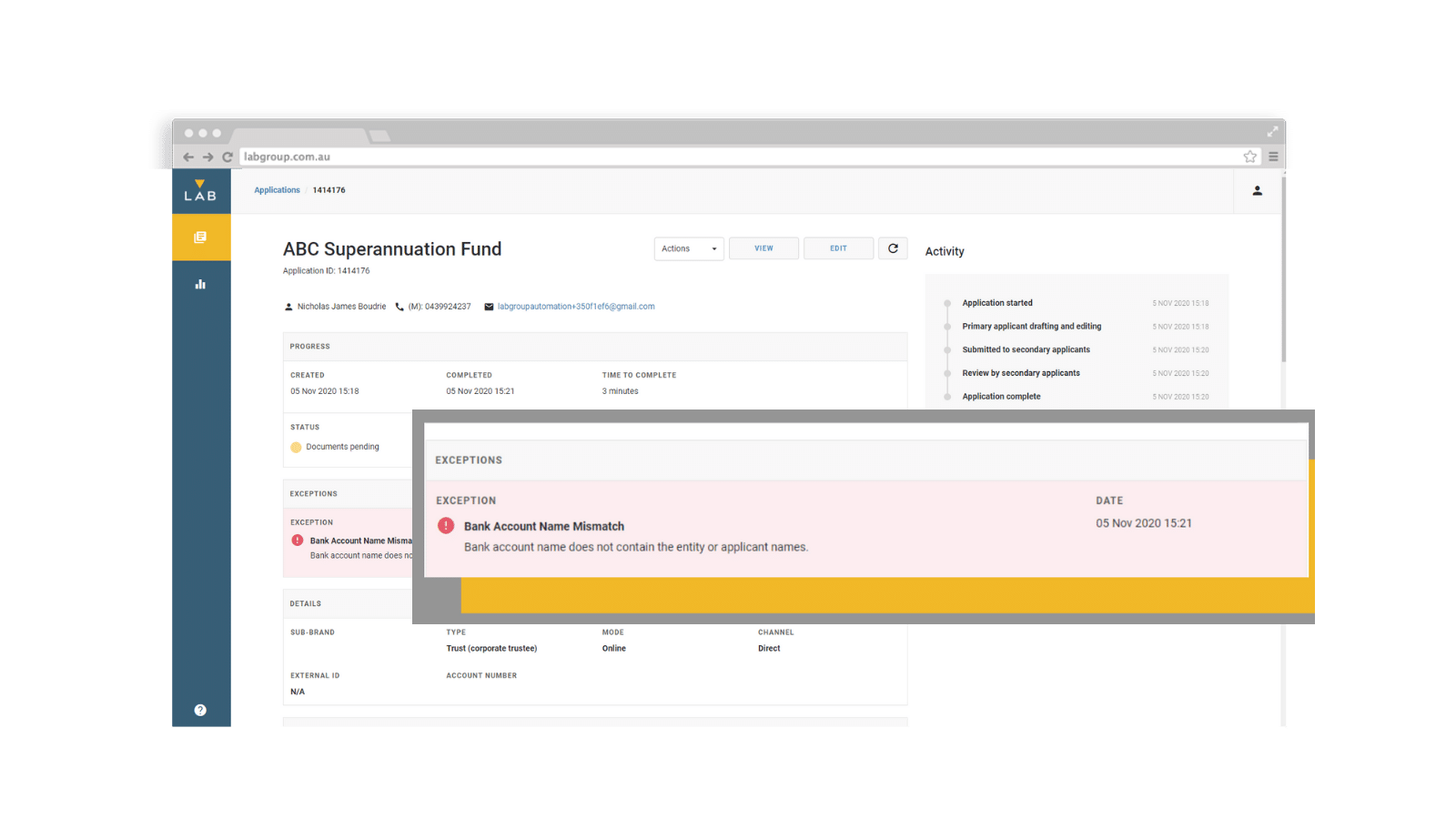

Cloud Based Application Manager

Advanced onboarding. CRM integrated. Functional.

Not only does LABform assist with acquiring new business and performing identity verification, LAB’s Application Manager assists with managing your customers and administering applications. Additionally, you will be able to follow up leads with automated email reminder functionality, manage work flows and monitor the progress of applications from beginning to end. Reduce time spent in chasing identification documents and accelerate the customer onboarding process.

Solutions

Onboarding

LABform and Application Manager are fully integrated onboarding solutions. Increase your application completion rate by more than 65% and quantifiably improve your Return on Advertising Spend by providing a simplified online application process.

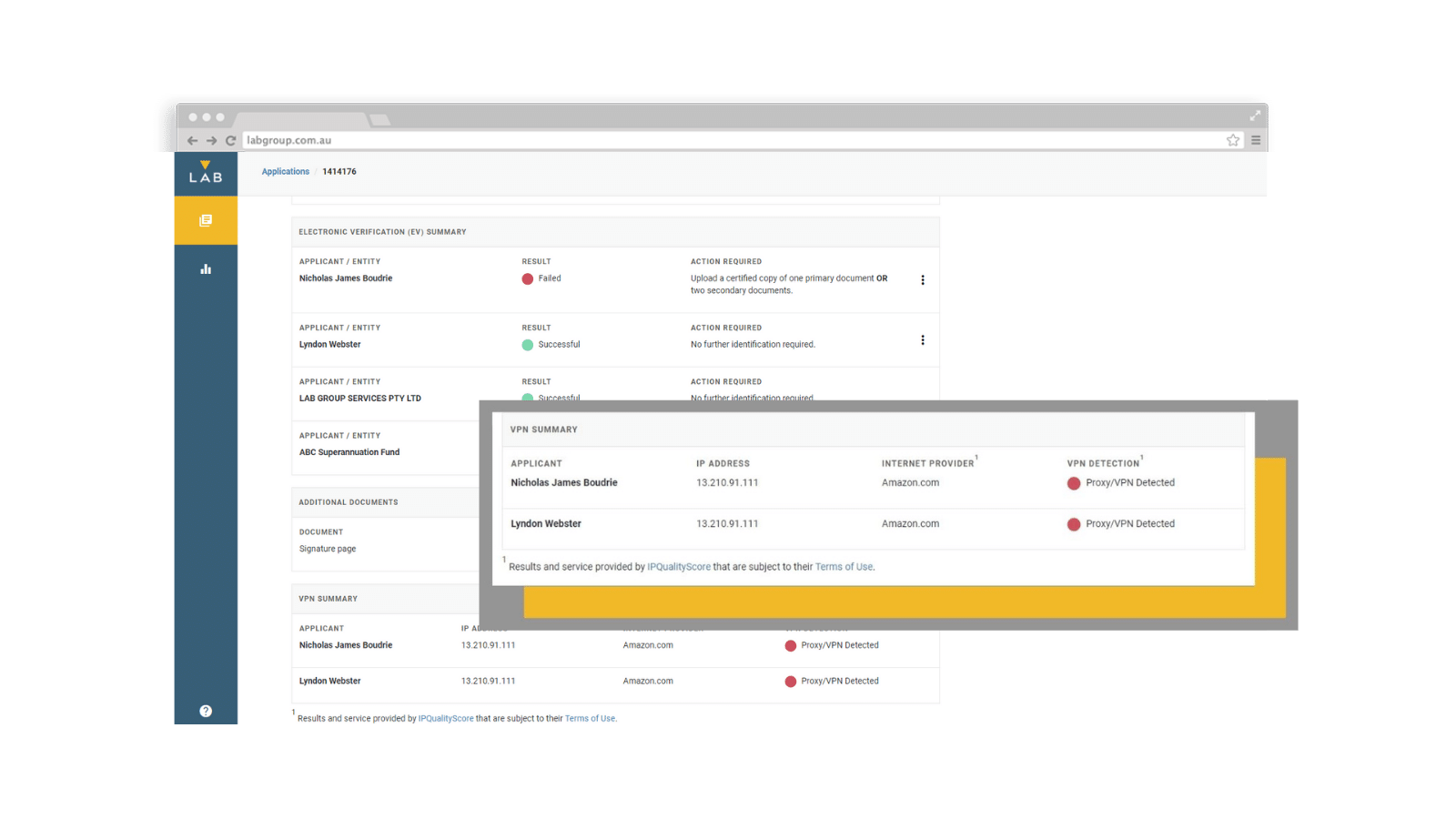

Identity

Our identity verification checks are automatic, complete within seconds and if successful eliminate the need for certified identification documents. Expect to see a dramatic fall in application rejection rates of up to 50% with LABform integration.

Integration

LAB Group has established API connectivity to a number of industry systems which means you get the cost efficiencies by leveraging the connectivity and experience that we’ve accumulated. Reduce onboarding timeframes from weeks to minutes.

Working with LAB Group

With over a million online applications processed, LABform has been successfully used across a number of areas of financial services including Banking, Stockbrokers, Superannuation and Pension Funds, Wealth Asset Management, Financial Advisers, Business and Property Lenders and Margin Foreign Exchange services and we have developed technology to simplify complex KYC processes and reduce fraud, legal and compliance risk.

1. Speak to Our Team

Enquire with our team to learn how our technology expands operational effectiveness, minimising administration costs and increasing application completion rates.

2. Product Demonstration

View a product demonstration showing how LAB Group can deliver a digital, connected experience for your customers and bring your digital acquisition process to life.

3. Customisable Branding

Configure our customisable features that include font and branding styles to integrate with your digital assets creating a seamless customer journey from your website to application completion and onboarding.

4. Community Access

Access the LAB Community for self service, thought leadership and other resources.

5. Technology Support

Our Help Desk provides technology support for ongoing improvement.

6. Compliance Monitoring

As a unified SaaS platform, our technology is continuously updated to remain compliant and relevant with industry trends and customer engagement methods.

7. Product Updates

Get access to updates, new features and continuous improvement with monitoring of advanced analytics and data analysis.

Case Studies

Changing Insurance Landscapes and Accelerated Digital Transformations

During the Coronavirus pandemic, regulators such as AUSTRAC strongly encouraged financial services companies to adopt digital processes to support a seamless, secure and compliant customer journey. Read how LAB Group rolled out a solution in less than 5 weeks for this large Australian Superannuation and Insurance Fund.

Customised solutions, Online Brokers and Electronic Verification Success

A digital client onboarding process is critical for brokers that want to provide the best possible client experience and drive scalable and cost-effective customer acquisition. Read how LAB Group responded to a 350% surge in demand for one client.