Powering the future of digital onboarding and lifecycle management

LAB combines innovative technology with comprehensive financial services experience to improve all aspects of client lifecycle management, which empowers institutions, corporates and SMEs.

Simplifying compliance across the entire customer journey

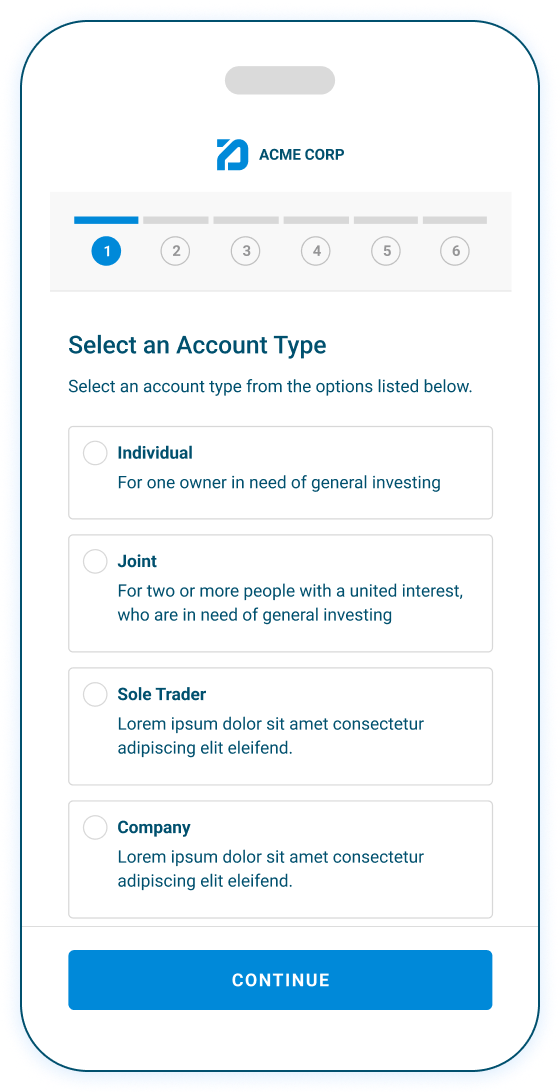

LAB Engage

LAB Verify

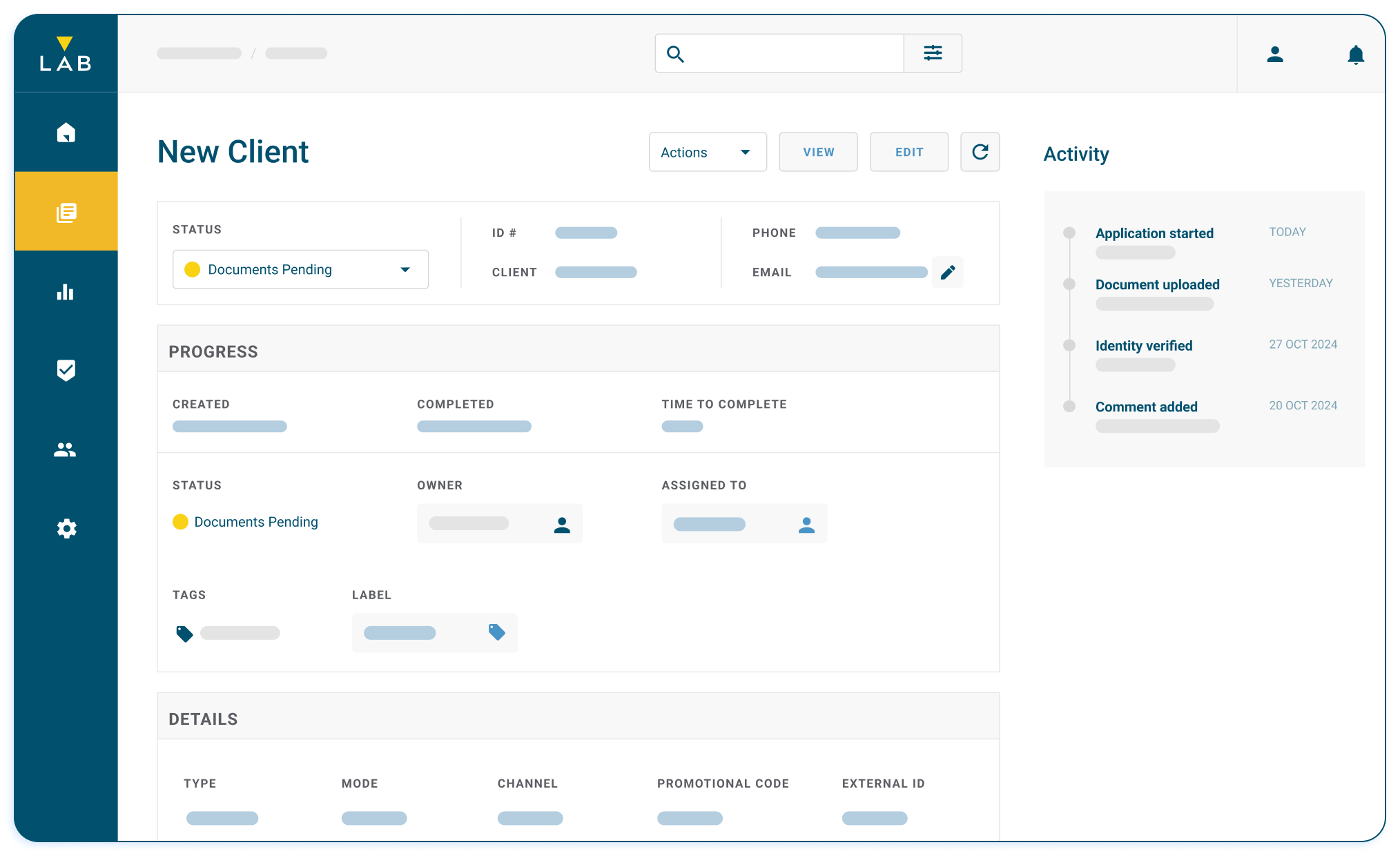

LAB Portal

LAB Service

The smarter way to stay compliant

LAB combines innovative technology with comprehensive financial services experience to improve all aspects of client lifecycle management, which empowers institutions, corporates and SMEs

Onboard more customers

Scale intelligent digital experiences for all customer types and entities, increasing conversion.

Reduce handling costs

Orchestrate front-load automation and business logic, reducing back-office handling and removing third-party fees.

Orchestrate verifications

Next-generation verification engine to facilitate KYC on all entity types across multiple countries and data sources.

Streamline operations

Cater for multiple countries and jurisdictions in a single solution, maintaining consistency and standardizing workflow.

Run seamless remediation

Automate and manage risk and compliance processing by engaging and verifying existing customers, ensuring you stay compliant on all matters including AML/CTF, KYC, Tax and Consents.

Multi-channel integrated solution

Penetrate the market facilitated by direct, advised, external platform and white-label product distribution. Horizontally scale across business lines and systems.

Unprecedented connectivity across products, onboarding channels and jurisdictions

LAB combines innovative technology with comprehensive financial services experience to improve all aspects of client lifecycle management, which empowers institutions, corporates and SMEs

Latest News

AML/CTF Reform Momentum Accelerates: What Comes Next – and How LAB Group Can Help You Stay Ahead

With the second exposure draft of the AML/CTF Rules closing for public consultation on 27 June 2025, Australia’s reform program…

AML/CTF Reform Momentum Accelerates: What Comes Next – and How LAB Group Can Help You Stay Ahead

With the second exposure draft of the AML/CTF Rules closing for public consultation on 27 June 2025, Australia’s reform program…

AML/CTF Reform Momentum Accelerates: What Comes Next – and How LAB Group Can Help You Stay Ahead

With the second exposure draft of the AML/CTF Rules closing for public consultation on 27 June 2025, Australia’s reform program…

Latest News

AML/CTF Reform Momentum Accelerates: What Comes Next – and How LAB Group Can Help You Stay Ahead

KordaMentha and LAB Group forge strategic partnership to deliver turnkey AML/CTF managed services

Navigating the Threat of Share Sale Fraud: How Robust Digital Solutions are Your Best Defence

Leading regulated entities choose LAB

LAB combines innovative technology with comprehensive financial services experience to improve all aspects of client lifecycle management, which empowers institutions, corporates and SMEs

Transform your customer journey with LAB Group

Join leading institutions that have modernised their compliance infrastructure and elevated their customer experience. Schedule a demo with our team to explore how LAB Group can transform your operations.