Our technology orchestrates digital workflow solutions for different use cases to improve the customer journey, accelerate complex customer onboarding and the secure verification of core customer information.

The LAB Network allows for the seamless transfer of data within and between organisations on the LAB Platform. The LAB Network has been built with learning and input from more than 100 leading financial institutions across global markets over the past 12 years.

Hundreds of regulated entities around the globe connect through the LAB Network to deliver:

- An enhanced customer experience

- Accelerated onboarding for all entity types

- Reusable investor profiles for all application types including complex applications across borders, jurisdictions, and multiple products

- Sophisticated delta management for the capture of additional information

- A single customer view and oversight of the customer record through the LAB Platform

- AML/KYC automation and verification (powered by LAB Verify)

- Automation and workflows for remediation and uplift

- Reusable IDs verified through the Trusted Digital Identity Framework (TDIF)

- Increased operational efficiencies

- Increased security and fraud detection

- Higher completion rates

- Out-of-the-box connectivity through LAB’s industry-leading partnerships and integrations

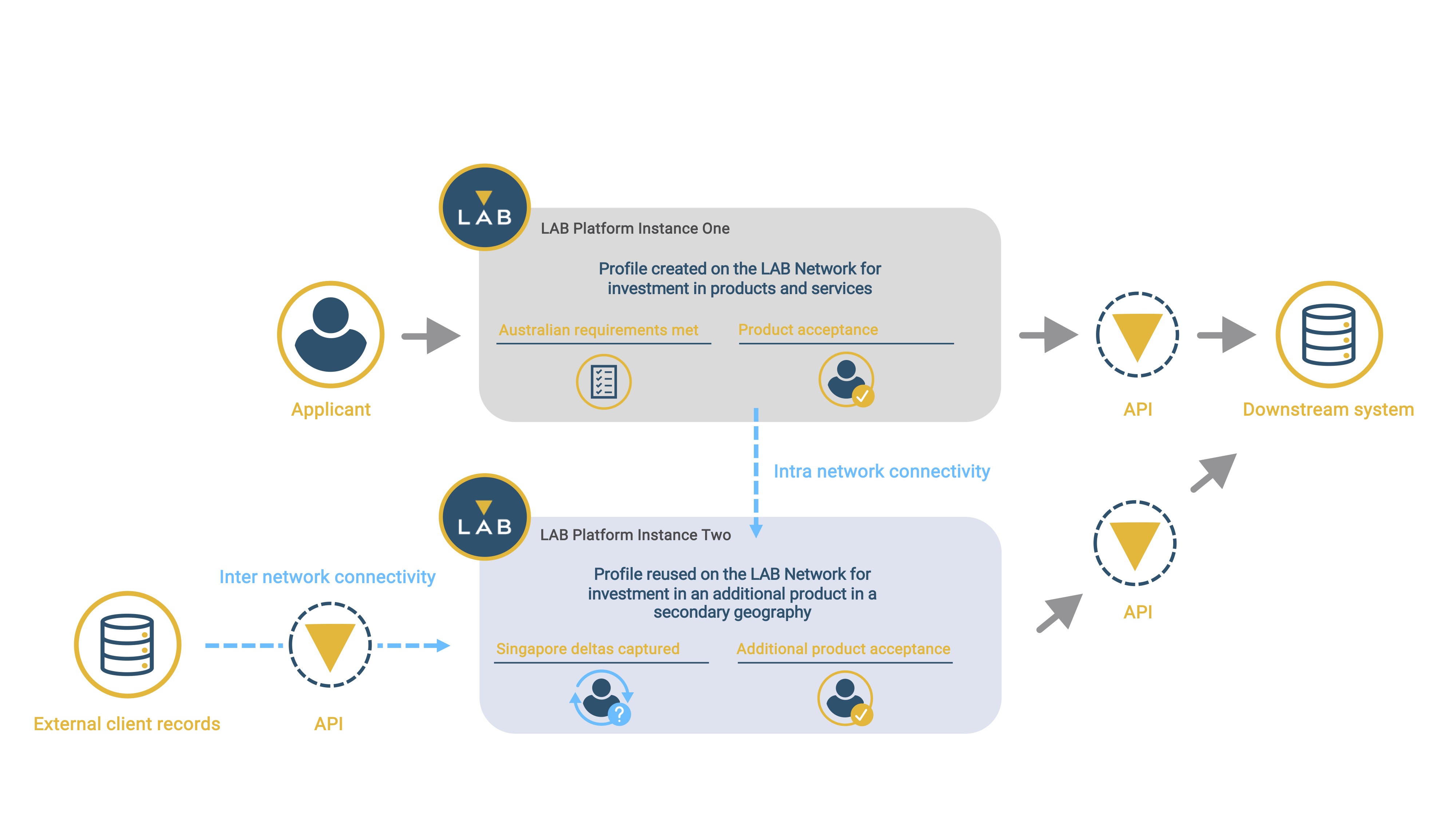

The following diagram breaks down how our technology orchestrates this seamless consented data flow along with a real-world example of each.

APIs

Allowing for consumer data to be received into the LAB Network from external sources.

Using the LAB Network, a financial adviser can now use a wealth management platform to push their client’s data into an instance of the LAB Platform to pre-populate client information into an equity product offering (LAB Group Integrates with Iress Xplan).

The LAB Network

Enabling the transfer of data within and between organisations on the LAB Platform.

If a new cash settlement account is also required, the client data can be sent to another LAB Network participant to streamline and expedite a secondary onboarding process.

Downstream Connectivity

A unique feature that allows data to move out of the LAB Network and into downstream connected systems and vendors, facilitating automated account activation.

The LAB Network’s downstream connectivity then allows all the consented client information to flow into a downstream pre-integrated clearing and settlement platform – so the client is up and running operating the account faster than ever (LAB Group Integrates with FinClear).

The LAB Network is innovating the way people connect to financial products & services through two core pillars:

LAB Connect

- Get to market sooner with LAB’s unrivalled connection through our industry-wide integrations and leading workflows.

- Reduce onboarding time, increase security and achieve higher completion rates.

- Enhance your origination and distribution network through strategic integrations and partnerships.

LAB Profile

- End customer profiles are centralised, AML managed and shared across products and organisations on the LAB Network.

- Profile reuse on the LAB Network generates efficiencies across jurisdictions and products, while automation and reporting tools reduce rework rates, onboarding times and operational costs.

LAB is ISO27001 certified and GDPR compliant, only temporarily handling customer data to activate accounts with depersonalisation applied to all audit trails.

The LAB Network enables the seamless consented movement of consumer profile data, offering consumers an unprecedentedly efficient onboarding experience into multiple providers across the Australian financial services market.