Onboarding is no longer static; customers flow across jurisdictions and markets.

Acquisition is no longer manual and slow.

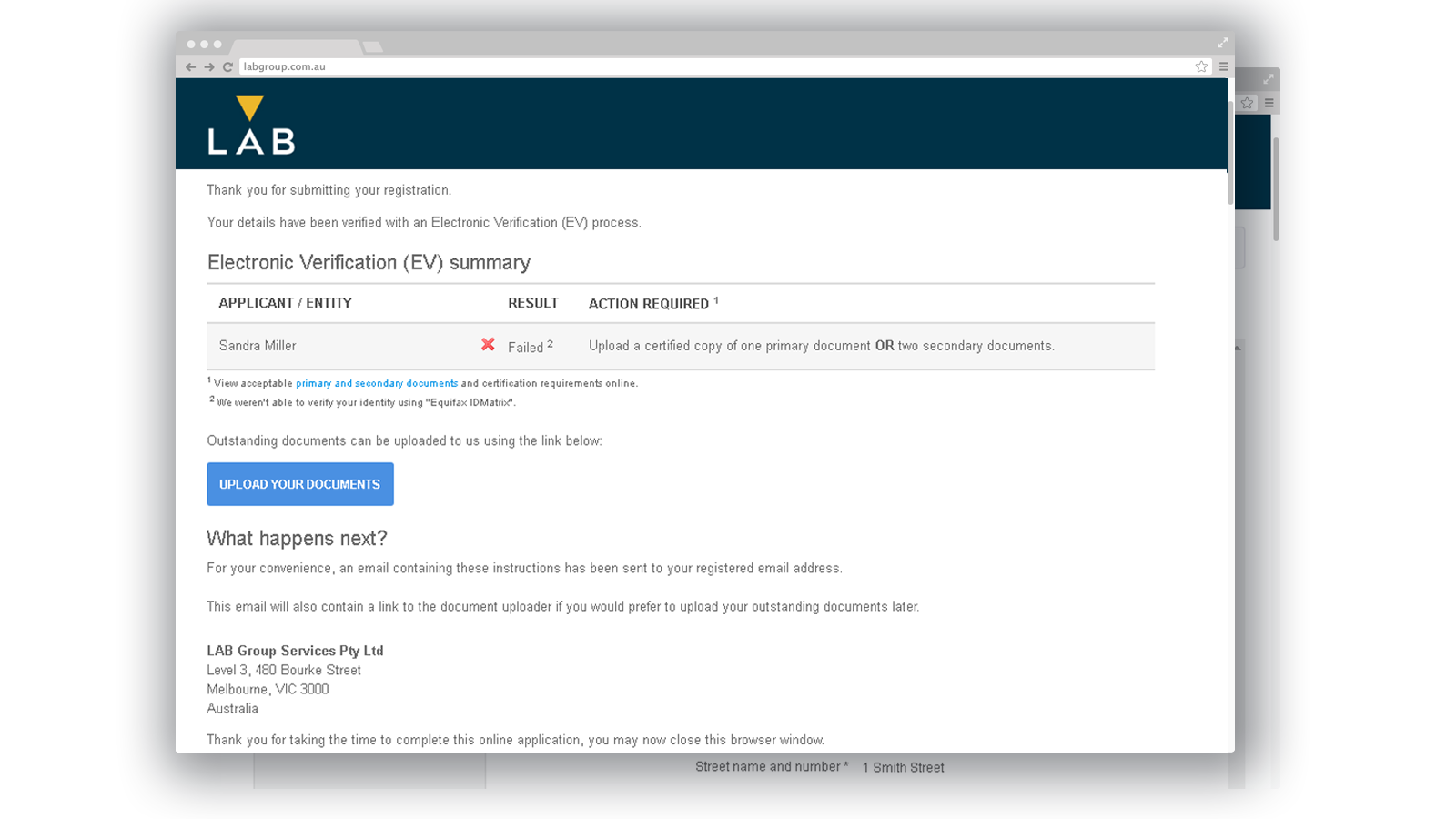

The future is frictionless; LAB Verify accelerates customer verification directly into your digital onboarding journey.

LAB Verify is an easy-to-integrate verification solution for all entity types that reduces onboarding time, costs, and the risk of regulatory fines.

• One API to consume all your verification needs

• API consumes and distributes data for Identity, Corporate Verification, PEP &

Sanctions Screening, Document Validity, and International Datasets

• Supports all entity types recognised under the AML/CTF legislation

• Helps organisations to automate AML and KYC verification for all entity types

• Produces a detailed response base on predetermined rules and logic

• Built to handle complex cross-regional verification needs

• Provides seamless country-of-origin verification and fraud prevention services

• Can work within the LAB Platform or as a stand-alone component to support

another onboarding framework

LAB is ISO27001 certified and GDPR compliant, only temporarily handling customer data to activate accounts with depersonalisation applied to all audit trails.

LAB Verify accelerates customer verification to meet the rapidly changing customer and regulatory requirements

across products and jurisdictions.

Financial Services

- AML

- KYC

- KYB

- KYT

- CTF

- FATCA

- CRS

Other Industries

- Tranche Two (AML/CTF Legislation)

- Australian Communications and Media Authority (ACMA) Reducing

Scam Calls and Scam SMS (Industry Code C661:2022) - Tax Practitioners Board (TPB) Proof of Identity Requirements

- Liquor and Gaming NSW Age Verification Requirements